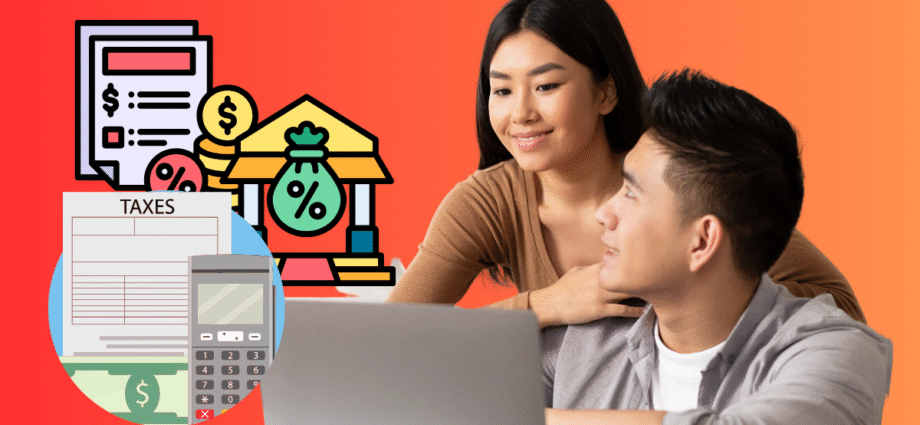

The rise of the digital economy has unlocked incredible opportunities for Filipinos. More than ever, professionals are leaving the traditional office setup for the flexibility and autonomy of freelance work and remote careers.

From virtual assistants and digital marketers to writers, designers, and developers, the “gig economy” is thriving. However, this newfound freedom comes with a new set of responsibilities, chief among them being the duty to manage your own taxes.

For many online workers, the Bureau of Internal Revenue (BIR) is a daunting and unfamiliar entity. The language of tax forms, deadlines, and computations can feel like a complex code designed to confuse.

This uncertainty often leads to inaction, with many freelancers inadvertently falling into non-compliance, risking significant financial penalties and legal troubles down the road.

But it doesn’t have to be this way.

This comprehensive guide is designed to demystify the process of tax compliance for Filipino freelancers and remote workers.

We will break down the essential steps, from registering your professional practice to filing and paying your taxes correctly and on time.

Think of this as your roadmap to becoming a BIR-compliant professional, empowering you to build a sustainable and worry-free career.

Why Bother with Taxes? The Importance of BIR Compliance

Before we dive into the “how-to,” let’s first address the “why.” Why should you prioritize getting right with the BIR? The reasons go far beyond just avoiding trouble.

First and foremost, it’s the law.

The National Internal Revenue Code of the Philippines mandates that every citizen earning an income, regardless of the source, must pay taxes. As self-employed professionals, the responsibility to declare income and pay the corresponding taxes falls squarely on your shoulders.

Ignoring this obligation can lead to hefty penalties, accumulating interest, and, in serious cases, legal action from the BIR.

Second, compliance gives you peace of mind.

The constant worry of being audited or suddenly receiving a large tax bill can be incredibly stressful. By being compliant, you eliminate this anxiety and can focus your energy on what you do best: serving your clients and growing your freelance business.

Perhaps most importantly, being a registered taxpayer builds your financial credibility.

Do you dream of buying a car, owning a home, or simply getting a credit card? Your Income Tax Return (ITR) is one of the most crucial documents required for loan applications, credit assessments, and even visa applications for travel.

Without official proof of your income, you are effectively invisible to financial institutions and embassies, limiting your ability to achieve major life goals. Your ITR is your most powerful tool for proving your financial capacity.

Finally, by paying your taxes, you are contributing to nation-building. The taxes you pay fund public services like infrastructure, healthcare, and education that benefit all Filipinos. It’s your share in building a better country.

Getting Started: Your Step-by-Step Guide to BIR Registration

The first step to becoming a compliant taxpayer is to officially register as a self-employed professional. This process formally tells the BIR that you are earning income independently.

Who needs to register?

Anyone earning income from a trade, business, or the practice of a profession. This explicitly includes all types of freelancers and remote workers, virtual assistants, consultants, online sellers, graphic designers, writers, etc. Even if your clients are based abroad, as long as you are a resident of the Philippines, your income is taxable here.

Where to Register?

You must register at the Revenue District Office (RDO) that has jurisdiction over your place of residence. You can find the right RDO for your address on the BIR website.

The Registration Checklist

Prepare the following documents to ensure a smooth registration process:

- BIR Form 1901 (Application for Registration): Download and fill out two copies of this form.

- Valid Government-Issued ID: Any government-issued ID that shows your name, address, and birthdate (e.g., Passport, Driver’s License, UMID, SSS ID).

- Proof of Address (Optional, but good to have): A utility bill or a Barangay Certificate under your name can sometimes be requested.

- Occupational Tax Receipt (OTR) or Professional Tax Receipt (PTR): You can get this from the city hall or municipal hall of your residence. This is a local government requirement for professionals.

- BIR Form 0605 (Payment Form): You will use this to pay the necessary fees.

- Books of Accounts: You will need to buy a set of journals (usually a ledger, a cash receipts journal, and a cash disbursements journal) and have them stamped by the BIR during registration. These will be used to record your business transactions.

The Registration Process

- Visit your RDO: Bring all your completed forms and requirements to the appropriate RDO.

- Submit Your Documents: An officer will review your application.

- Pay the Fees: You will be instructed to pay the Annual Registration Fee (P500) and Documentary Stamp Tax (if applicable) at an Authorized Agent Bank (AAB).

- Receive Your Certificate of Registration (COR): Once you’ve paid, return to the RDO with your proof of payment. They will then process and issue your Certificate of Registration (BIR Form 2303).

Your COR is a vital document. It contains your Taxpayer Identification Number (TIN), registered address, and, most importantly, the tax types you are required to file. For most freelancers, this will be Income Tax and Percentage Tax.

The Core Obligations: Understanding Your Taxes

Once registered, your main duty is to compute, file, and pay two primary types of taxes.

1. Income Tax – This is the tax levied on your professional income. As a self-employed individual, you have two options for computing your income tax:

- Graduated Income Tax Rates (0% to 35%): This is the default option. Your tax rate depends on how much you earn. The first P250,000 of your annual net taxable income is exempt from tax. Any income beyond that is taxed at rates from 15% to 35%. Under this scheme, you can either claim itemized deductions (e.g., internet, electricity, supplies, salaries) or opt for the Optional Standard Deduction (OSD), which is a flat 40% deduction from your gross receipts. The OSD is simpler as it doesn’t require you to present receipts for your expenses.

- 8% Flat Income Tax Rate (Optional): This is a popular choice for freelancers due to its simplicity. If your gross annual sales or receipts do not exceed the Value-Added Tax (VAT) threshold of P3 million, you can choose this option. You pay a flat 8% tax on your gross receipts in excess of P250,000. The best part? This 8% rate is in lieu of both the graduated income tax and the 3% percentage tax, simplifying your obligations significantly.

2. Business Tax – This is a tax on the sale of your services. Most freelancers will fall under one of two categories:

- Percentage Tax: If your gross annual receipts do not exceed P3 million, you are subject to Percentage Tax. This is a 3% tax on your gross quarterly earnings. You must file this tax every quarter. (Note: This rate was temporarily reduced to 1% under the CREATE Act but reverted to 3% effective July 1, 2023).

- Value-Added Tax (VAT): If your gross annual receipts exceed P3 million, you are required to register as a VAT taxpayer. This involves a more complex system where you charge a 12% VAT to your clients and remit it to the BIR. For most new and growing freelancers, Percentage Tax is the relevant business tax.

The Filing and Paying Routine: Your Tax Calendar

Compliance is a cycle. Here are the forms and deadlines you need to remember:

Quarterly Filings:

- Percentage Tax:

- Form: BIR Form 2551Q

- Deadline: Within 25 days after the end of each taxable quarter (e.g., April 25 for Q1, July 25 for Q2).

- Income Tax:

- Form: BIR Form 1701Q

- Deadlines:

- 1st Quarter: May 15

- 2nd Quarter: August 15

- 3rd Quarter: November 15

Annual Filing:

- Annual Income Tax Return (ITR):

- Form: BIR Form 1701A (if you opted for OSD or the 8% rate) or BIR Form 1701 (if you chose itemized deductions).

- Deadline: On or before April 15 of the following year. This consolidates all your income for the previous year.

How to File and Pay in the Digital Age

The BIR has made compliance easier for remote professionals.

- Filing: Use the eBIRForms software package, which you can download from the BIR website. You fill out the digital forms offline and then use the software to submit them online.

- Paying: Once your return is filed, you can pay your taxes through various online channels, eliminating the need to visit a bank. Popular options include:

- GCash

- PayMaya

- Landbank Link.BizPortal

- DBP Pay-Tax Online

- UnionBank Online

Pro-Tips for Smart Freelance Tax Management

- Keep Meticulous Records: Use a spreadsheet or a simple accounting app to track every invoice and every business-related expense.

- Open a Separate Bank Account: Do not mix your personal and business finances. Have all client payments deposited into a dedicated business account. This makes tracking your income much easier.

- Set Aside Your Tax Money: As soon as you receive a payment, set aside a percentage (a safe estimate is 20-30%) in a separate savings account. This ensures you always have funds ready when tax deadlines arrive.

- When in Doubt, Consult a Professional: Tax rules can be complex. If you feel overwhelmed, investing in a consultation with an accountant or tax professional can save you a lot of time, money, and stress in the long run.

Conclusion: Embrace Your Professional Journey

Becoming a tax-compliant freelancer is not just about fulfilling a legal duty; it’s a crucial step in professionalizing your practice.

It signals that you are a serious business owner who is building a sustainable and legitimate career. The process may seem intimidating at first, but by taking it one step at a time, you can navigate it with confidence.

Don’t let the fear of the unknown hold you back. Use this guide to take that first step, register your business, and embrace the financial clarity and peace of mind that comes with being a proud, tax-paying Filipino professional.

You Might Also Like:

The Best Digital Nomad Visas of 2025: Your Global Work-Life Guide

Top 10 Things to Do in Newcastle upon Tyne: A Local's Guide to the Toon

Winter in Sydney: A Magical July Adventure in Australia

Ditch the Cubicle, Aloha the Wifi: Top 10 Digital Nomad Havens in the Philippines

Experience Authentic Thai Food: A Culinary Journey For Your Taste Buds

Your Ultimate Guide to Cross-Border Taxation for Filipino Remote Workers

- Top Digital Nomad Cities in Latin America (2026 Edition) - 15 December 2025

- Top Digital Nomad Cities in Europe (2026 Edition) - 14 December 2025

- Top Digital Nomad Cities in Asia (2026 Edition) - 14 December 2025