Introduction

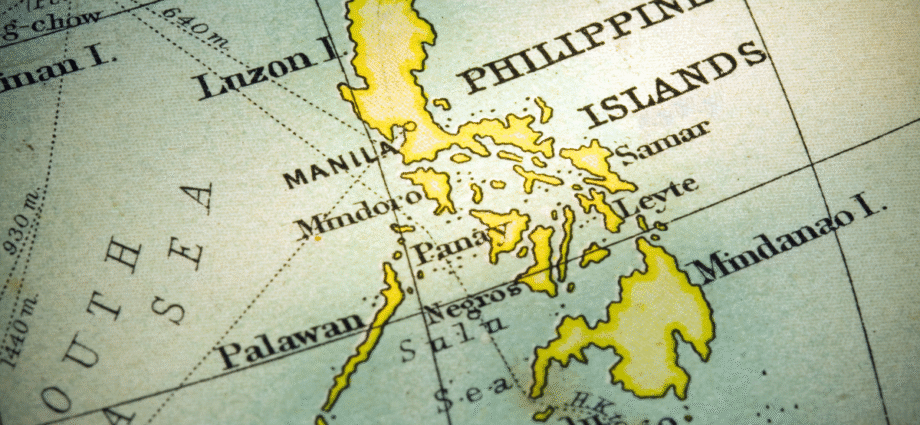

Remote work and “digital nomad” lifestyles have surged in popularity over the past few years. The Philippines – an archipelago of over 7,000 islands known for its warm hospitality and low cost of living – has been catching the eye of roving professionals.

In fact, the World Economic Forum ranked the Philippines as the 7th fastest-growing remote work hub in the world in 2023. This raises the question: Can you register as a digital nomad in the Philippines? In 2025, the landscape is evolving.

Both foreigners who wish to base themselves in the Philippines and Filipinos who embrace location-independent work need to navigate a changing legal framework. This comprehensive guide – drawing on both legal and tax insights – will examine the feasibility of being a digital nomad in the Philippines, recent policy developments (2022–2025), and what they mean for freelancers and remote employees alike.

The Rise of Digital Nomad Visas in Southeast Asia (2022–2025)

Across Southeast Asia, governments have been rolling out special visas to attract remote workers. In the last three years, several neighboring countries introduced “digital nomad visas” to capitalize on the remote work trend. For example:

- Malaysia launched the DE Rantau Nomad Pass in 2022, a one-year visa (renewable once) targeting digital professionals with an annual income of at least US$24,000.

- Thailand introduced its Destination Thailand Visa (DTV) in 2024, a five-year visa (multiple entries up to 180 days at a time) aimed at freelancers and creatives, requiring proof of foreign income and a THB 500,000 (~US$14,500) bank deposit. Thailand also rolled out a 10-year Long-Term Resident (LTR) visa for high-earning professionals (US$80,000+ annual income) with tax perks.

- Indonesia offers a Bali Digital Nomad Visa (E33G) for one-year stays (income ~$60,000/year, foreign-sourced income only) as well as a longer “Second Home” visa for retirees/investors.

- Vietnam has no formal nomad visa yet, meaning remote workers rely on tourist or business visas and face some uncertainty for long-term stays.

Until recently, the Philippines lacked a dedicated digital nomad visa and thus lagged behind its peers. Many foreign remote workers simply used tourist visas in the Philippines, a legal gray area that was tolerated in practice (immigration officials generally “looked the other way” as long as one didn’t work for a local employer).

However, this informal approach left nomads without legal certainty or long-term status. Recognizing the opportunity to boost tourism and the economy, the Philippine government moved to create a formal Digital Nomad Visa (DNV) program in 2025.

The New Digital Nomad Visa in the Philippines (2025)

For the first time, the Philippines is launching a structured Digital Nomad Visa for foreign nationals. Announced in April 2025 by President Ferdinand “Bongbong” Marcos Jr. via Executive Order No. 86, this visa provides a legal pathway for non-Filipinos to live in the Philippines while working remotely for overseas employers or clients.

It was further backed by proposed legislation (Senate Bill No. 2991 and House Bill No. 795) to solidify the framework.

Key features of the Philippines’ Digital Nomad Visa (DNV) include:

- Validity: 12 months, renewable for an additional 12 months (total up to 2 years). After that, one would need to reapply or exit as per the forthcoming rules.

- Remote Work Only: Visa holders cannot engage in local employment or business with Philippine clients. All work must be for employers/clients outside the Philippines. This safeguard ensures digital nomads don’t compete for local jobs and helps classify their income as foreign-sourced.

- Financial Requirement: Expected minimum foreign-sourced income of around US$24,000 per year (about PHP 1.3 million). Applicants must show proof of sufficient income and remote work (e.g., contracts, bank statements). (Final regulations will confirm the exact amount.)

- Other Requirements: Applicants must be at least 18, have a clean criminal record, private health insurance valid in the Philippines, a return or onward travel ticket, and proof of accommodation in the Philippines. Notably, there’s also a reciprocity condition – the applicant should be from a country that offers a similar visa to Filipinos, to ensure mutual openness.

- Application Process: The visa will be processed via a new online e-visa platform with a 4–6 week turnaround. Applicants apply through Philippine embassies/consulates abroad (which verify documents). Once approved, the nomad must register with the Bureau of Immigration upon arrival, likely obtaining an Alien Certificate of Registration (ACR) card for the duration of their stay.

Status: The Digital Nomad Visa program is slated to launch by June 2025. Government agencies (DFA, DOJ, DOT, BI, BIR) have been tasked to finalize guidelines and even conduct a pilot implementation within 60 days of the April 2025 order. This means that by mid-2025, foreign remote workers will have a clear, legal way to reside in the Philippines beyond the normal 30- or 59-day tourist visas.

Why this matters: It formally removes the ambiguity around foreigners working remotely on tourist status. With the DNV, digital nomads can legally “register” themselves in the Philippines as remote workers. They gain peace of mind and longer stays, while the Philippines hopes to attract “global citizens to live, work, and contribute to our economy”. The Philippines is positioning itself as a competitive destination for digital nomads, joining its ASEAN neighbors with a “middle-ground approach” policy.

Legal Considerations for Foreign Digital Nomads in the Philippines

For foreign nationals, the primary legal consideration is immigration status: you must have a visa that allows you to stay and work remotely. Here’s how the options compare:

- Tourist Visa (Short-Term): Many nomads historically entered on a 30-day visa-free entry or tourist visa and kept extending. While doing online work on a tourist visa wasn’t explicitly permitted, it was largely unenforced as long as you had no local employer. However, a tourist visa is intended for leisure; you are officially “there for vacation…that’s it”. Extensions could let one stay up to 36 months, but renewals beyond the first year can attract questions. With the advent of the Digital Nomad Visa, relying on perpetual tourist status may become less common (and authorities could tighten enforcement on long-staying “tourists” who are clearly working online).

- Digital Nomad Visa (1–2 Years): The new DNV grants a temporary resident status for up to 1 or 2 years specifically for remote work. Legally, this is a special non-immigrant visa category. Visa holders must continually meet the conditions (e.g., maintain foreign income, no local employment) or risk revocation. One unique condition is reciprocity: if your home country doesn’t offer a digital nomad visa to Filipinos, you might be ineligible. (This aims for fairness, though it remains to be seen how strictly it’s applied. Citizens of countries without any remote work visa – for instance, some Western countries – may need to clarify eligibility under this rule.) Assuming you qualify, the DNV is the ideal route for a foreign remote worker in the Philippines – providing legal clarity and stability.

- Other Visa Options: Depending on individual circumstances, some foreigners have used other visas. For example, a Student Visa (if studying) or the Special Resident Retiree’s Visa (SRRV) for those over 35 with certain investments/deposits. Others with Filipino family ties might use marriage or quota visas. However, these are situational. There is also a long-term “workation” visa concept announced by the Bureau of Immigration in 2021 (allowing up to 6-month stays for remote work), but it was a limited policy and superseded by the new DNV initiative. For the majority of digital nomads, the DNV will be the most straightforward legal pathway as of 2025.

Local Compliance: The DNV explicitly bars any local employment or business engagements. This means as a foreign digital nomad, you should not take on Filipino clients or gigs or seek local payroll jobs. You also won’t need a local work permit since you’re not employed by a Philippine entity. Essentially, you operate entirely in the international sphere while enjoying life in the Philippines. It’s wise to keep documentation (contracts, client invoices) proving your work is foreign-related, in case immigration or tax authorities ever inquire.

Life and Logistics: Holding a residence visa like the DNV can make practical aspects easier. You’ll likely be issued an ACR I-Card, which can help in opening a local bank account or signing leases (things notoriously tricky on a short tourist visa). The Philippines offers an English-speaking environment and a growing number of coworking spaces and expat communities, which is a boon for foreign freelancers. By formalizing the status of remote workers, the country is hoping to entice more nomads to choose a Filipino beach town or city as their next base.

You Might Also Be Interested: The Best Digital Nomad Visas of 2025: Your Global Work-Life Guide

Tax Considerations for Foreigners: Will You Pay Philippine Taxes?

One of the biggest perks of the Philippine Digital Nomad Visa is on the tax front: visa holders will not be considered tax residents in the Philippines. In other words, as long as you earn from foreign sources and have no Philippine clients, your income is not subject to Philippine income tax. This is by design, similar to many countries’ digital nomad visa programs, which exempt foreign income from local taxation to attract applicants.

To break it down: under Philippine tax law, foreigners are taxed only on income from Philippine sources, regardless of residency status. Even if you become a resident alien by staying more than 183 days in a year, the law still limits your taxable scope to Philippine-sourced earnings. Remote work for an overseas employer doesn’t count as Philippine-sourced income. Therefore, a digital nomad in the Philippines with only foreign clients owes 0% Philippine income tax on that income.

Caution: It’s important to truly keep all work and revenue foreign-based. If you breach the visa conditions and, say, take on a local consulting gig or side business, that income would be Philippine-sourced and taxable (and also a violation that could void your visa). The visa’s explicit prohibition on local work is intended to prevent this scenario. Assuming compliance, even a foreign nomad who stays long-term (beyond 180 days) “is not liable for Philippine income tax” on their remote earnings.

Additionally, staying under 180 days classifies a foreigner as a non-resident alien, taxed only on local income at a flat 25% rate. Since you won’t have local income, short stays also incur no Philippine tax. In summary, whether you stay 4 months or 24 months on the DNV, your foreign remote income remains untaxed by the Philippines. This tax-neutral stance is a huge incentive for “tax-savvy remote workers” looking to save on income taxes while enjoying their nomadic lifestyle.

Home Country Taxes: Of course, “tax-free in the Philippines” doesn’t necessarily mean tax-free worldwide. Digital nomads should be mindful of their home country’s tax rules. Some countries tax their citizens on global income regardless of where they live (e.g., the United States). Others may consider you a tax resident if you’re away for less than half the year. Fortunately, many nomads come from countries that allow breaks in residency or have territorial tax systems. It’s advisable to consult a tax professional or use any applicable tax treaties to avoid double taxation. Bottom line: the Philippines will graciously not tax your foreign earnings, so ensure you handle any obligations back home.

Other Taxes: As a foreign resident, you wouldn’t pay Philippine social security or insurance contributions (those are tied to local employment). You also won’t be subject to business taxes like VAT since you won’t be selling goods or services locally. If you spend money in the Philippines (rent, dining, etc.), you’ll pay the normal consumer taxes embedded in prices, but there’s no special expat levy. One could say the DNV lets you enjoy the infrastructure without bearing tax burdens – a win-win if you also contribute to the local economy through spending and tourism.

Filipino Digital Nomads Working from Home: Freelancers and Remote Employees

What if you are a Filipino who wants to be a digital nomad or remote worker? There are two scenarios: working within the Philippines vs. outside the Philippines. Each has different legal and tax implications.

Filipino Freelancers & Remote Employees in the Philippines

Filipino citizens who work remotely while residing in the Philippines do not need a special visa or permit to perform foreign work – you’re a citizen in your home country, free to work here. However, “location-independent” does not mean “law-exempt.” You must comply with Philippine laws on business registration, taxation, and possibly local licenses:

- Business/Tax Registration: In the eyes of the Bureau of Internal Revenue (BIR), a Filipino freelancer is a self-employed professional. You are generally required to register with the BIR and obtain a Taxpayer Identification Number (TIN) if you are earning income, even from foreign clients. This involves filing BIR Form 1901 and paying a one-time PHP 500 registration fee, among other steps. Many online freelancers register either as a professional (self-employed) or as a sole proprietor business. Both are viable; registering as a “professional” is common for those offering services solo. If you anticipate hiring people or branding a business, a sole proprietorship might fit, but it comes with more paperwork. In either case, registration with the BIR is legally required for Filipino freelancers working via the internet.

- Local Permits: Aside from BIR, you may need to secure a local Occupational Tax Receipt (OTR) or Professional Tax Receipt (PTR) from your city/municipality, as well as a Barangay clearance and maybe a Mayor’s permit, especially if you register a business name. These are standard requirements for any self-employed individual in the Philippines. They ensure you pay any minimal local taxes/fees due and adhere to regulations. The process may sound tedious, but it’s usually straightforward (small fees for OTR, etc.).

- Income Tax Obligations: Unlike foreign nomads, Filipino residents are taxed on worldwide income. That means whether your client is in Manila, New York, or London, the earnings are subject to Philippine income tax if you’re a resident citizen of the Philippines. The good news is you’re entitled to the same tax brackets and exemptions as any employee. Under current rates, the first PHP 250,000 of annual income is tax-exempt, and higher amounts are taxed progressively (15% to 35% on brackets above that). Many freelancers earning modestly might find their tax due is low or nil after expenses and personal exemptions. Furthermore, small businesses or professionals earning under PHP 3 million annually can opt for an 8% flat tax on gross revenue in lieu of income tax and percentage tax, this simplifies compliance for many freelancers. Professional advice is recommended to choose the optimal tax scheme for your case.

- Do Remote Employees Pay Tax? Yes. If you’re a Filipino working from home as an employee of a foreign company, you still owe Philippine income taxes on that salary. Typically, your foreign employer is not registered in the Philippines and won’t withhold Philippine taxes for you, so you must report and pay them yourself. In practice, you would file an annual income tax return declaring that the foreign-paid salary as income. It falls under “self-employed resident citizen earning income from anywhere in the world” per BIR classifications (effectively treated similarly to a freelancer). Ensure you set aside funds for the tax bill, since no one is withholding it during the year. You may also need to pay quarterly estimated taxes. While this is an extra administrative step, it’s crucial to stay on the right side of the law, tax compliance will prevent problems down the line.

- Social Contributions: One consideration for remote workers is government benefits. Without a local employer, PhilHealth, SSS, and Pag-IBIG Fund contributions aren’t automatically handled. Freelancers and self-employed individuals can (and should) contribute voluntarily to these programs for continued healthcare coverage, pension, and housing loan eligibility. Registration as self-employed with these agencies is relatively straightforward. While not a legal requirement to keep working, maintaining contributions is a smart move for long-term security and is encouraged.

- No Special “Digital Nomad” Status (Yet): Unlike some countries that have tax breaks for citizens working abroad, the Philippines currently does not have a distinct legal status for “domestic digital nomads.” A Filipino working remotely in Siargao or Baguio is essentially just a self-employed individual in the eyes of the law. There have been discussions about encouraging the IT-BPO sector and freelancing, but no specific tax holiday or incentive solely for digital nomads in-country. That said, income from foreign clients may be zero-rated for VAT purposes if properly documented (since it’s an export of service). If you register as a business and your clients pay in foreign currency, discuss with a tax advisor whether you can avail 0% VAT on those revenues, which can save 12% in costs.

In summary, Filipino remote workers at home can absolutely pursue a digital nomad lifestyle. Still, they must “register” in the traditional sense – i.e., register their freelance business and pay taxes in the Philippines. The feasibility is high given the strong internet infrastructure in many cities and a growing support network for freelancers. Just don’t neglect your BIR registration and annual filing, because the penalties for unreported income can be steep. As one guide bluntly puts it: Yes, freelancers in the Philippines must pay taxes – in short, “Do freelancers pay taxes? In short, yes.”. The upside is that doing it right from the start spares you headaches later.

Filipino Digital Nomads Abroad: Working While Traveling

What if a Filipino decides to become a digital nomad abroad, roaming from country to country (or settling temporarily in a foreign locale) while working remotely? This scenario introduces both immigration and tax considerations:

- Immigration Abroad: Filipino passport holders enjoy visa-free or visa-on-arrival access to many countries for short stays (often 30 to 90 days, depending on the country). For longer stays geared towards remote work, Filipinos can take advantage of the same digital nomad visas that other nationalities use. Many of the ASEAN schemes mentioned earlier (Malaysia’s DE Rantau, Thailand’s DTV, Indonesia’s Bali visa) are open to all nationalities, including Filipinos, as long as you meet the income and other requirements. For instance, a Filipino remote consultant could apply for Thailand’s 5-year DTV by showing proof of foreign income and the required bank deposit. Malaysia’s one-year nomad pass would be attainable if they earn above US$24k/year. These programs do not discriminate by citizenship (in fact, the Philippines’ own DNV will accept only foreigners from countries that reciprocate, a policy that implicitly encourages other countries to include Filipinos). Outside ASEAN, dozens of countries from Georgia to Portugal offer remote work visas that Filipinos can explore if they meet the criteria. Always check the specific visa rules – some require proof of income, health insurance, or background checks similar to the Philippine DNV.

- Tax Residency When Abroad: A crucial benefit for Filipinos who truly move abroad is that they can change their tax status to “non-resident citizen.” The Philippines taxes resident citizens on worldwide income, but non-resident citizens are taxed only on income from Philippine sources. In other words, if you leave the Philippines and live overseas as a digital nomad, and you have no Philippine-sourced income, you won’t owe Philippine income tax on your remote earnings. This is why many Overseas Filipino Workers (OFWs) don’t pay Philippine tax on their foreign salaries. The key is that you must genuinely qualify as a non-resident, typically by staying outside the Philippines for over 183 days in a year and having no intention to reside in the Philippines that year. If you meet that, you have effectively zero Philippine tax on your foreign remote income. For example, a Filipino graphic designer who spends 2025 hopping between Thailand, Bali, and Vietnam (without coming home) would likely be a non-resident citizen for 2025 and not taxed by BIR on the dollars she earns from clients on Upwork.

- Local Taxes Abroad: The next question is whether the host country will tax you. The beauty of many digital nomad visas (Philippines’ included) is that they explicitly do not make you a tax resident of the host country when your income is foreign-sourced. For instance, Indonesia’s planned nomad visa was touted to allow tax-free stay if all income is offshore. Thailand’s DTV and Malaysia’s DE Rantau similarly focus on remote income and generally do not impose local income tax on that income (Thailand even has separate tax-friendly LTR visa for high earners). Each country’s rules vary, but 17% of digital nomad visa programs globally explicitly exempt nomads from local tax and many others implicitly do so if you have no local employer. As a Filipino abroad on one of these visas, you often end up in a tax-neutral position: not taxed by the host (because of visa conditions) and not taxed by the Philippines (because you’re non-resident), essentially tax-free on your income. This is a huge financial advantage of the nomad lifestyle, though again, you must mind each country’s specific laws to maintain that status. Always verify if staying beyond a certain period could inadvertently trigger tax residency (for example, some countries might consider you tax-resident if present more than183 days without a special visa, but the nomad visa might override that).

- Maintaining Filipino Obligations: Even while abroad, you might want to keep your Philippine life in order. If you continue to maintain, say, a residence or business in the Philippines, be careful – any Philippine-source income (like rental income from a property at home) remains taxable even if you’re overseas. Also consider keeping your PhilHealth/SSS active (PhilHealth now offers a Overseas Filipinos program). And importantly, ensure you have a plan for healthcare and insurance while traveling.

- Feasibility: From a feasibility standpoint, many Filipinos are already thriving as digital nomads abroad, taking advantage of their English skills and global demand for services. Southeast Asia is particularly friendly: cultural similarities and cost of living make transitions easier. For example, Filipinos in Chiang Mai’s nomad scene or in Bali integrate well, often blending in with both locals and the international nomad community. With the Philippines now embracing foreign nomads, we may see more exchange and mobility for Filipino nomads too. The requirement in the Philippine DNV that the foreigner’s home country allow Filipinos to do the same means countries will hopefully keep opening their doors wider for Philippine citizens.

Bottom line: A Filipino can absolutely “register” themselves as a digital nomad – if in the Philippines, by doing the proper tax registrations; if overseas, by leveraging new visa opportunities and managing their residency status. In either case, the lifestyle offers immense freedom, but it comes with the responsibility of staying legal and compliant, both at home and wherever you go.

Read More: Spain’s Digital Nomad Visa: A Comprehensive Guide for Remote Professionals and Freelancers

Comparing the Philippines and Neighboring Nomad Policies

With the Philippines jumping into the fray, how does it compare to its neighbors? Here’s a quick snapshot for context:

- Philippines (2025) – Digital Nomad Visa, 1 year + 1 year renewable (total 2 years). Est. US$24k annual income requirement. No local work allowed; foreign income not taxed locally. English-speaking country with low cost of living and improving internet – now with a formal framework to support nomads.

- Thailand – Destination Thailand Visa (DTV): 5-year visa, but requires periodic exits (max 180 days per entry, renewable annually). Requires proof of foreign income and ~US$14.5k in a Thai bank. Long-Term Resident (LTR) visa: 10-year option for high earners (US$80k/year) with tax perks. Thailand’s nomad visas are generous in length, but they do have steep income/asset requirements at the high end.

- Malaysia – DE Rantau Nomad Pass: 12 months, renewable once. Income requirement ~US$24k/year. Comes with access to designated “Digital Nomad Hubs” (co-working and community spaces) in cities like Kuala Lumpur and Penang. Malaysia’s program is quite accessible and family-friendly (allows dependents), positioning itself as a regional hub for remote professionals.

- Indonesia – Bali Digital Nomad Visa: 1-year stay in tropical Bali for those earning ~US$60k/year from abroad. No local clients allowed, reinforcing the tax-free foreign income angle. Second Home Visa: 5-10 year residence for those who can deposit ~US$130k in an Indonesian bank, more for retirees or wealthy individuals than typical nomads. Indonesia has strongly signaled that bona fide digital nomads in Bali won’t be taxed locally on foreign income, which, like the Philippines, aims to attract talent without tax worries.

- Vietnam – No dedicated nomad visa yet. Many remote workers use three-month tourist visas or temporary business visas and renew them. Vietnam remains popular due to its affordability and vibrant expat scene, but the lack of a formal program means longer-term stays can be logistically complicated.

From this comparison, the Philippine DNV requirements appear moderate, similar to Malaysia’s income threshold and term, more accessible than Thailand’s high-end visas, and offering a longer stay than Indonesia’s Bali visa. The Philippines also stands out by requiring reciprocity, a provision not seen in other countries’ programs. The common thread in all these is that remote workers are generally exempt from local taxes on foreign income and barred from local jobs, which is true for the Philippines as well.

For a Filipino looking at the region, these programs mean you have options: you could base yourself in one country for a year under a nomad visa, then hop to the next, all while remaining legally compliant and minimizing taxes.

For foreign nomads, the Philippines now offers an alternative destination, perhaps appealing for its language compatibility (English), friendly culture, and countless travel destinations.

In essence, Southeast Asia is becoming a digital nomad-friendly zone, with each country contributing its own flavor of remote work visa. The Philippine DNV adds depth to this ecosystem, complementing rather than competing with its neighbors to make the region a haven for mobile professionals.

Conclusion

So, can you register as a digital nomad in the Philippines? As of 2025, the answer is Yes – both in spirit and letter. Foreigners have a clear legal pathway via the new Digital Nomad Visa to reside in the Philippines and work remotely, free from local taxes and bureaucratic uncertainty.

Filipinos, on the other hand, can absolutely partake in the digital nomad movement: if staying in the Philippines, you must register your freelance or remote work activity with the proper authorities (BIR, local permits) and fulfill tax obligations like any professional. If wandering abroad, you now have unprecedented visa options in many countries, and you can opt out of Philippine taxation by becoming a non-resident citizen while you travel.

The past three years have ushered in a new era of flexibility. The Philippine government’s acceptance and formalization of digital nomads reflects a broader cultural shift: work is no longer a place, and policies are catching up to that reality. For remote workers and freelancers, this means more freedom to choose where to live and work – be it a beach in Cebu or a coworking loft in Bangkok, without falling into legal limbo.

Just remember that with freedom comes responsibility. Always keep your paperwork in order – visas, permits, tax filings, so you can enjoy the laptop lifestyle with peace of mind. Consult with a CPA or lawyer (I happen to be both) if you’re unsure about any requirement; a little planning goes a long way to avoid issues.

The Philippines is embracing the digital nomad trend with open arms and a pragmatic framework. In doing so, it’s not only opening its doors to the world’s remote workers but also empowering Filipino professionals to explore new horizons. With the right legal footing and tax planning, being a digital nomad in the Philippines is not just feasible – it’s an exciting opportunity to reinvent the way we work while exploring one of the world’s most beautiful destinations. Safe travels and happy coworking!

You Might Also Like:

From Side Hustle to Sole Proprietor: How to Register Your Business in the Philippines

Accounting Basics for Creatives and Online Entrepreneurs in the Philippines

Tax Obligations for Filipino Freelancers and Remote Workers: What You Need to Know

Your Ultimate Guide to Cross-Border Taxation for Filipino Remote Workers

- From Davao to Alicante: What No One Tells You About Moving to Spain - 24 February 2026

- Reinventing Yourself in Your 30s: Career, Country, and Calling - 22 February 2026

- The Economics of Global Beauty Pageants: A Deep Financial Breakdown - 22 February 2026